Find the best plan for your business

Online business finances with no hidden fees.

Essential

/month (excl. VAT)

Fast, easy business banking, invoicing & bookkeeping for small teams.

Take a free 30-day trial

Business Account & Cards

- ATM cash withdrawal limit of €1,000/month.

- Expand your limits with premium cards: Plus Card, Metal X Card on demand.

- International SWIFT transfers available in 17 currencies from €5/transfer.

Invoicing & Expense Management

POPULAR

Business

/month (excl. VAT)

Team spend & expense management tools plus a dedicated Key Account Manager.

Take a free 30-day trial

Business Account & Cards

- ATM cash withdrawal limit of €1,000/month.

- Expand your limits with premium cards: Plus Card, Metal X Card on demand.

- International SWIFT transfers available in 17 currencies from €5/transfer.

Invoicing & Expense Management

Enterprise

/month (excl. VAT)

The complete package for larger teams, with advanced tools & our highest limits.

Take a free 30-day trial

Business Account & Cards

- ATM cash withdrawal limit of €1,000/month.

- Expand your limits with premium cards: Plus Card, Metal X Card on demand.

- International SWIFT transfers available in 17 currencies from €5/transfer.

Invoicing & Expense Management

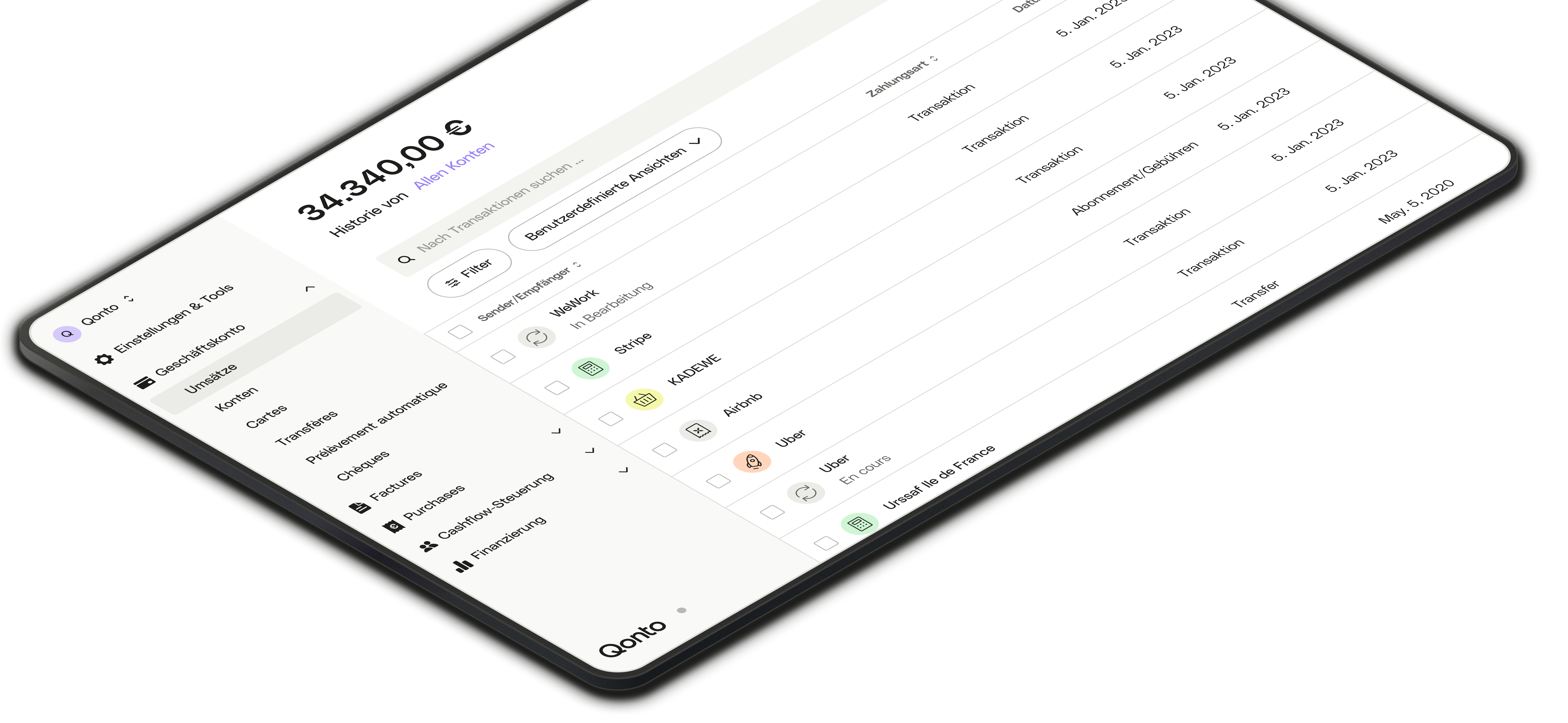

Slick app

A simple, smart, all-in-one app with industry-best ratings. So you can always keep track of your finances.

Rapid support

Your questions answered by our team via chat, email or phone. Any day of the year.

Always secure

From Strong Customer Authentification to 3D Secure, we use the most advanced methods to protect your money.

Regulated

The German branch of Qonto is subject to supervision by BaFin and ACPR.

4.8

on App Store

4.7

on Play Store

4.6

on Trustpilot

Frequently Asked Questions

Is Qonto a bank?

Qonto is not a bank but rather a payment institution supervised by the Banque de France (under the number CIB 16958). We enable companies (existing ones or those in the process of being registered) to benefit from a payment account and all the means of payment necessary for the smooth running of their business (physical and virtual cards, direct debits, international transfers, cheque deposits).

As a regulated payment institution, all our customers’ funds are secured. The funds deposited in your Qonto account are totally separate from Qonto’s treasury.

The funds are partly “segregated” in the books of Crédit Mutuel Arkéa. The other part is invested in qualified money market funds, the units of which are held in the books of Société Générale in accordance with our legal and regulatory obligations.

This means that no one but you has access to your money. Neither Qonto nor anyone else can use or invest your company’s money.

For more information please refer to this article.

What are the advantages of the Qonto service?

Whether your company is already registered or is in the process of being created, we have offers adapted to all to guide you through the different stages of your company's life.

Whether you are alone or in a team, Qonto provides you with all the payment methods you need to manage your business in real time. Qonto offers metal cards for professionals and allows the reception of SWIFT transfers (from abroad).

Much more than a current account, Qonto simplifies your daily life with a range of features that make it easier to keep an eye on everyone's expenses and prepare your daily accounting.

Since 2019, we have been using our own banking platform (also known as the Core Banking System), which allows us to carry out our clients' transactions ourselves. This independence allows us to offer a smoother experience to our clients and to directly create the products and services that make their day-to-day life easier.

Our mission is focused on the needs of professionals and their expectations. This is why our customer service is ultra responsive and attentive, with people ready to answer your questions as quickly as possible.

Qonto's pricing and offers are transparent. All monthly subscriptions come without commitments. You can switch from one plan to another at any time if your business needs to change.

400 000 business customers have already joined Qonto to simplify their day-to-day financial management - why not you?

Who can open a Qonto account?

Qonto is designed for all professionals and companies who wish to optimize their daily financial and accounting management. The opening of a Qonto business current account is currently accessible to companies registered in France (SA, SAS, SASU, SARL, SC & SCI, EURL, liberal professions, micro-enterprises). Italian, Spanish or German companies also have the possibility to manage their finances on Qonto.

In France, Qonto also allows registered associations to create an account for professional purposes.

Qonto also makes it easier to set up a business by giving future entrepreneurs the opportunity to open an account and deposit the initial share capital (excluding SCIs and companies domiciled in French overseas departments and territories) required to register and obtain their Kbis and SIREN number.

Are there any fees or commissions in addition to the monthly subscription?

There is no movement commission in addition to the cost of the subscription.

In other words, if you do not exceed the transaction volume and services included in your subscription, you will only be charged for the monthly rate of your subscription.

If you order additional cards or make additional transactions (over those included in your subscription), additional fees will be charged. Find all the details on the fees for additional cards and services here.

How do international payments work?

Transfers

Your Qonto account allows you to receive transfers from all over the world and send money in more than 32 foreign currencies via the SWIFT network. This feature is included in some of our plans. Discover all our plans and what they include from our Pricing page.

Payments by card

All of our Qonto cards accompany and insure you when you travel. If you are a frequent traveler, we advise you to order one of our Plus or X Cards.

With the Plus Card you benefit from a low, 1% exchange rate commission on card payments outside the Euro zone.

With the X Card, all your payments abroad are made at the real exchange rate (without any exchange commission) and your withdrawals are free of charge.

These two cards come with premium insurance to protect you and your teams when travelling.

What are special operations?

SEPA Creditor Identifier creation

The SEPA Creditor Identifier (ICS) enables you to debit your customers' accounts via SEPA Direct Debit. If you need it, please note that Qonto won't charge you any additional fees.

Confirmation letter

It is a regulatory document that companies may need annually in the event of an audit. Please note that Qonto will not charge you any additional fees for requesting a confirmation letter.

Management of irregularities

10% of the amount requested by the seizing authority, up to a maximum of €75 excl. VAT.

An irregularity occurs when the tax administration or a creditor through a legal authority demands reimbursement of an unpaid debt. As a payment institution, we are required to take the steps to reimburse your debt: this is what we call a seizure of bank accounts.

Capital increase

€150 excl. VAT

Capital increase enables the creation of new shares, which can then be purchased by one of the current shareholders or by a new shareholder.

Ready? Sign up in minutes.

Qonto’s goal is to protect what’s most precious to entrepreneurs: their time, energy and focus. We've made signing up quick and easy, so you can see exactly what we mean...

Möchten Sie zu Deutsch wechseln?

Möchten Sie diese Webseite auf Deutsch ansehen?