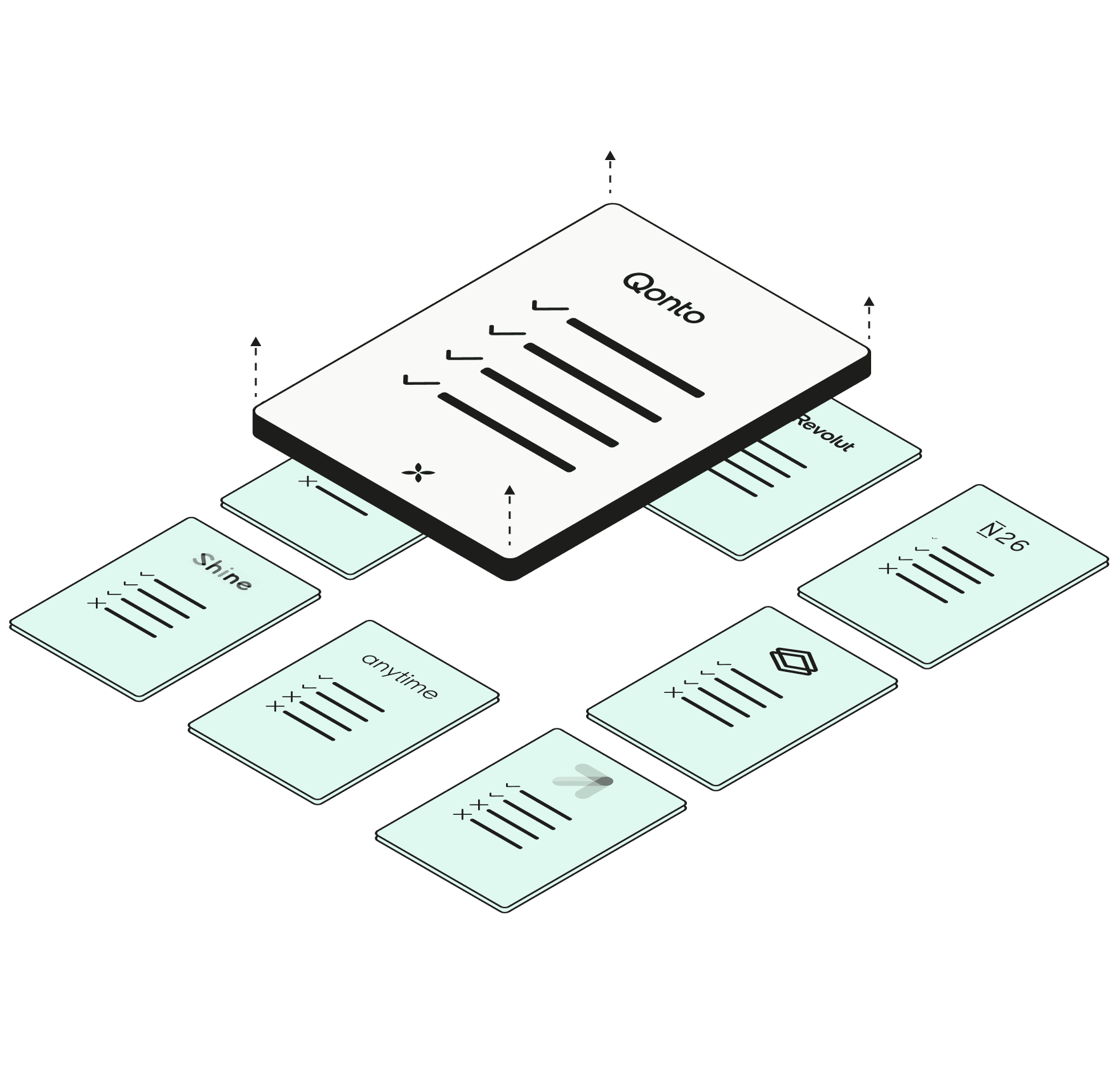

Online business banking comparator

Compare Qonto and other online business banking services.

Comparison made on March 4, 2022.

€2,500

Monthly pricing

Capital Deposit

IBAN

Bank overdraft granted

€2,500

Legal forms

Help for bank switch

Type of card provided

Card transactions in euros

Non-euro card payment

ATM withdrawal

ATM withdrawal limits

Payment limits

Google Pay / Apple Pay

Card reader

Virtual card

Disposable card

pricing

In/out SEPA transfers in euros

Outgoing SEPA transfers in foreign currencies

pricing

Incoming SEPA transfers in foreign currencies

Debits

Checkbook

Check cashing

Maximum amount per check

Receipt certification and archiving

Receipt certification and archiving

Automatic VAT detection

Invoicing

How does an online banking comparator work?

Online banks and special features

Business finance management solutions and online-only banking solutions don't necessarily own the same licences as traditional banks. However, they can offer similar services for a business bank account: payment cards, a local IBAN, real time payments etc. They also have an edge in that they are digital only. You don't need to make an appointment to open a business account or to deposit your share capital. You can use the same services, but in a more convenient way.

Online banks and accounting services

Besides fees, you will also want to compare the bookkeeping services that online banks can provide. All entrepreneurs who have experience of doing their accounting will be able to confirm that it's an energy and time consuming task. Having the opportunity to execute it via a banking service will help you focus on your project.

Online banks and fees

It's important to compare bank fees. Indeed, online banks don't offer the same price plans and they might vary significantly from one to another. Besides the account opening fees, some extra costs could apply for special features or options. A good indicator of your needs is the legal form of your company!

Compare customer services of online banking services for professionals

Customer service is key when it comes to online banks. You have to make sure someone will be able to answer your questions when you need them to. To compare the different customer services, an entrepreneur can always consult reviews online, but a qualitative comparator will help to identify the most appropriate ones.

Ready?

Whether you're a self-employed contractor or a small business with a team,

Qonto can provide the business account you need.